Terms & Conditions

By using the information, services of SM bookkeeping, you are agreeing to the terms and conditions contained herein, which are subject to change without notice.

Fees and payments

Payment and fees should be made in full by the due date, 7 days from the date shown on the invoice. The client agrees to pay the company the agreed fee and any disbursements.

Termination

This engagement may be terminated at any time by either party. In the case of termination, you agree that payment for all services accrued up to and including the date of termination will be paid immediately upon receipt of our invoice.

Complaints

If you would like to make a complaint to SM Bookkeeping please email. A senior member of our team will make contact in 4-5 working days

Fair and Responsible Usage of our Services

We aim to provide an affordable bookkeeping service to small and medium sized businesses. As such, we aim to provide support, advice and assistance without specified limits where these are considered to be a reasonable level of requests on the time of our team. Where we consider that you are exceeding our fair usage limits, we will inform you of this fact. This will likely involve a revision in pricing to reflect the true cost of the service being used.

Services

If we are appointed to complete your bookkeeping, we will need to collect all your support documentation before completing the accounts. We require only digital copies of your invoices, bills, receipts and relevant contracts. It is therefore your responsibility to ensure you keep and store the hardcopies and originals for the specified periods defined by the relevant authorities

Privacy

In accordance with the Data Protection Act the company and its employees will treat the client’s personal information as private and confidential. The client however should be aware that their contact details may be used during the process of providing the companies services on behalf of the client.

The company and its employees can not be held responsible for the security of any goods, documents or premises and its contents.

Standards

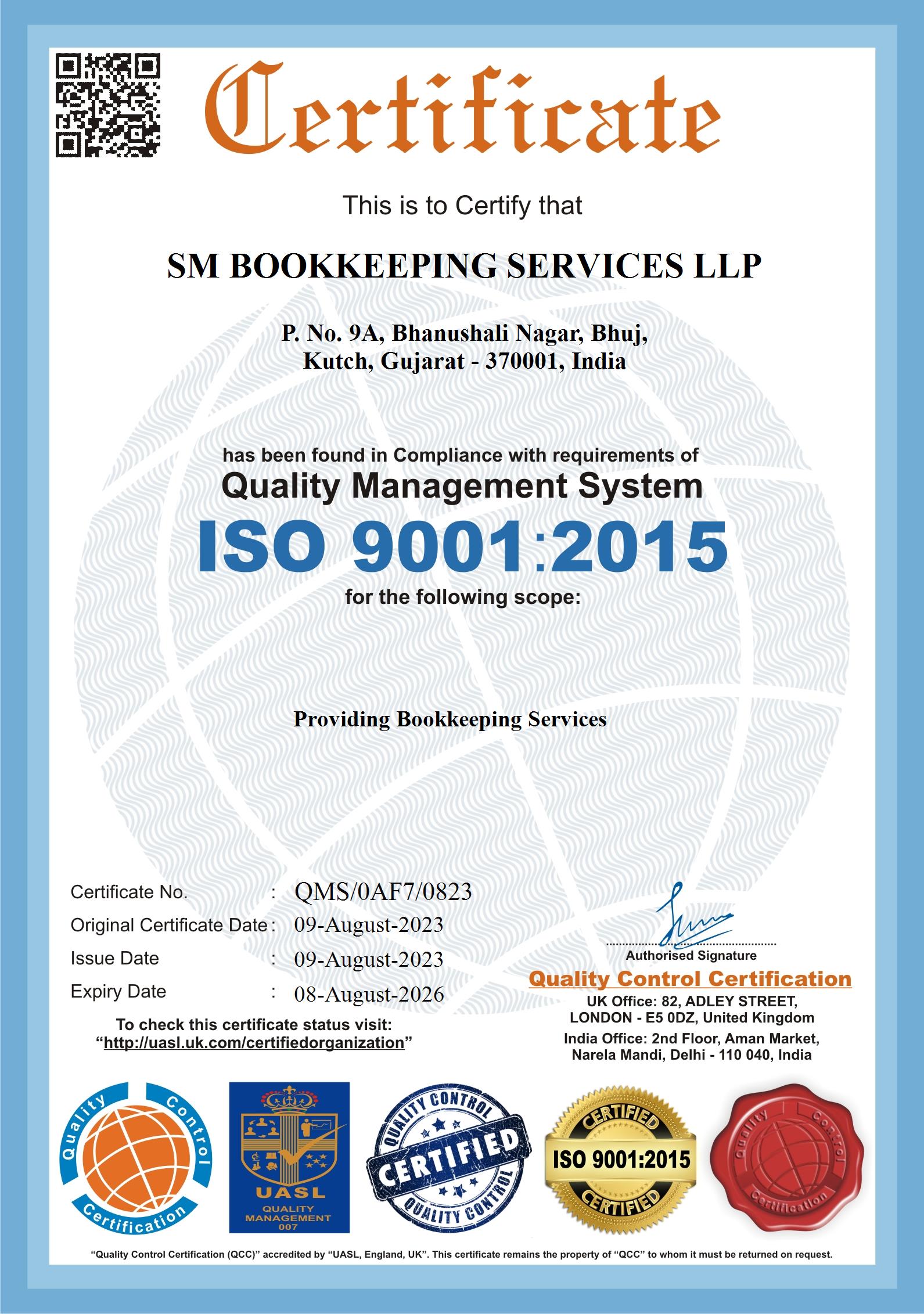

SM Bookkeeping aims to provide the highest standard of professional service and are focused on the concerns of our clients. If for any reason you feel you have not received the level of service expected or have an issue to raise, please contact your HYBK consultant to discuss how the problem may be resolved.

Appointment as a Contractor

SM Bookkeeping is an independent contractor, not an employee. As such, you are not held to the obligations of an employer such as annual leave, payroll tax, etc. However, the following rights are upheld, consistent with an independent contractor status:

- SM bookkeeping has the right to perform services for others during this engagement;

- SM bookkeeping has the sole right to control and direct the means, manner and method by which the services are performed;

- SM bookkeeping has the right to hire assistants, use employees and contractors to provide the services required;

- This engagement does not create a partnership relationship; you, nor we, have the authority to enter into contracts on the other's behalf.

Disclaimer

The information contained in this website was prepared for general information purposes only. All images, photographs and graphics are indicatives only. Users of this website and prospective customers should not rely on any of the information herein contained as forming part of an offer, contract or undertaking. All information contained in this website was considered to be correct at the time of publication.